Demand Draft How to send Demand Draft

Contents:

This is very informative article thank you for this information. But I want to know how am I submit DD cancellation latter in the bank. If you want to read on more banking topics you may read here.

Core Banking Solutions is a buzz word in Indian banking at present, where branches of the bank are connected to a central host and the customers of connected branches can do banking at any branch with core banking facility. Also called receiving banker, who collects on instruments like a cheque, draft or bill of exchange, lodged with himself for the credit of his customer’s account. Customers may choose to keep themselves informed by referring to the information that is available in the public domain or any other reliable source, with regards to the products and services that they may be interested in.

Demand Draft for Payment of Road Tax

bank draft example drafts are usually issued when a large amount of money is in question or within parties who are unknown to each other and thus lack trust. Instead ofwriting a checkor paying with debit and bank cards, customers present checking account info to the business to arrange draft funds. If you are away from house oryou do not have a checking account, you can strive walking into another bank’s department and asking.

- After moratorium R.B.I. and Government explore the options of safeguarding the interests of depositors by way of change in management, amalgamation or take over or by other means.

- A bank draft is a check that is drawn on a bank’s funds and guaranteed by the bank that issues it.

- You should keep your Phonebanking PIN strictly confidential.

- TDS, when due and applicable will be deducted in accordance with the provisions of the Income Tax Act,1961 and the Rules thereunder as in force.

- ICICI Bank Statement ICICI Bank is one of the largest private sector banks in India,…

You should not keep a written record of your Phonebanking PIN in any way that may enable another person to use it. You should promptly report to us any loss, theft, disclosure or unauthorised use of your Phonebanking PIN. VIII. In no circumstances will we be responsible to you or any other person for any loss of profit or interest, indirect or consequential loss arising from or in connection with our providing, or failure or delay in providing, the Services. Accounts upon which an attachment order or other legal notice prohibiting operations of the accounts has been received will be frozen ruled off and no further operation will be allowed till such time that the prohibition order is removed. We reserve the right to close any account without assigning any reason by giving a prior notice of 30 days to you.

Effective 01 January 2020, no charges applicable if the NEFT transactions done through Personal Internet and Mobile Banking. These cheques can be cleared at any place in the respective bank branch. When trotting around the globe, the traveller’s cheque comes as handy as you can encash these cheques for your overseas travel rather than carrying physical money in your wallet.

Demand Draft in Favor of RTO for Fancy Number

Typically, banks will evaluate the financial institution draft requester’s account to see if enough funds can be found for the verify to clear. The bank creates a check to the payee drawn on the financial institution’s personal account. The name of the payer is famous on the examine, however the financial institution is the entity making the payment. Similar to a cashier’s check, a legitimate financial institution draft is safer than a private examine when accepting giant payments. To get a banker’s draft, a financial institution customer should have funds out there.

You should not write down or keep the PIN on or close to your ATM Card or in any way that may enable another person to use your ATM Card. The Bank remains entitled to assign any activities to any third party agency at its sole discretion. Iii) Only one nomination can be made for each account, RBI approval is required for repatriation of proceeds where nomination is filed in favour of the NRI. The Bank has appointed a service provider for collecting the items from the CDBs.

You authorise us to contract with collecting banks and other persons in relation to the arrangements and matters set out in paragraph above. Accountholders should exercise care when drawing cheques and should not draw cheques by any means, which may enable a cheque to be altered in a manner, which is not readily detectable. Upon receipt of a cheque book or before use, you should check the cheque serial number, account number and your name printed on the cheques and the number of cheques, and report any irregularity to us as soon as reasonably practicable. Interest is not taxable in case of NRE and FCNR Fixed Deposits held by individuals. In the case of NRO deposits, tax is deducted at source at the rate of 30.9 %.

Life Insurance

As the name indicates, the drawer of the cheque is also the drawee, or the remitter is the same person or entity as the beneficiary. These cheques can be processed in any branch of the same bank within the city. In all these situations, the banker’s cheque or banker’s draft or pay order is your ‘go to’ option. If the mode of delivery is courier, the Demand Draft will be mailed to your registered address.

But if there is a court order then the payment will be stopped by the bank. Animesh does not have a bank account with HDFC Bank, but he wants to get a DD from the bank. He can still get it by visiting any branch of HDFC Bank and completing the formalities required.

Annual Percentage Rate is the annual rate that is charged for borrowing expressed as a single percentage number that represents the actual yearly cost of funds over the term of a loan. The purpose of the number is to function as a reference and comparison of similar rates. APR assumes significance because lenders/banks may quote interest rates in different ways to customers and the period of investment may vary from one day to many years. ## Subject to Internet Banking Limits as designated on Customer’s HSBC account.

Economic Improvement by Enhancing Operations of Pakistan’s Ports – Modern Diplomacy

Economic Improvement by Enhancing Operations of Pakistan’s Ports.

Posted: Sat, 25 Mar 2023 18:34:23 GMT [source]

Then a large number of RTO’s in India accept the payment via a Demand Draft. But in the case of an RTI filing that falls under the state government. You will have to find out the details of the public information officer.

Account Statement

Deposits which are withdrawn on demand by customers.E.g. Certificate of Deposits are negotiable receipts in bearer form which can be freely traded among investors. This is also a money market instrument, issued for a period ranging from 7 days to f one year .The minimum deposit amount is Rs. 1 lakh and they are transferable by endorsement and delivery.

A bank draft is a fee that is assured by a bank on behalf of a payer. These payments are usually inexpensive for merchants than credit card funds , and lessprone to chargebacks. If someone pays you with a financial institution draft, you possibly can’t at all times assume you’ll get the money.

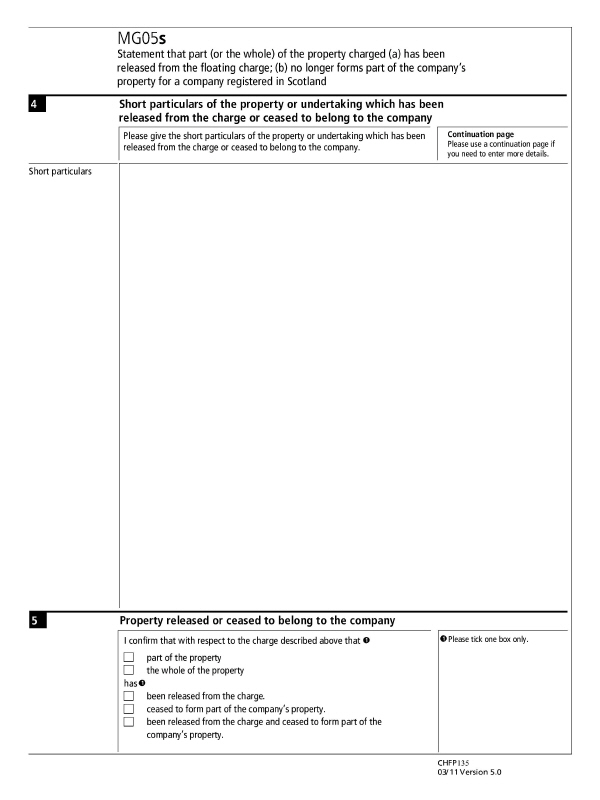

The remittor is to submit a request to issue Demand Draft. Exchange control regulations are applied in overseas remittances. CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner.

A https://1investing.in/ institution draft is safer than a private check when accepting giant payments. To get a banker’s draft, a bank buyer should have funds obtainable, and the bank will freeze or keep those funds in the financial institution’s personal account until the fee is completed. Take it to your bank or credit union and endorsethe again of the document.